Soldato

I'd expect it to fall some still, just hesitating in this area is quite positive as it may go lower and very likely come back here so its not the wrong price as such even if cheaper happens. Bottom pricing will take a while to be confident on, this whole year probably.

Oil isnt staying low forever as not growing things to eat and so on, has to occur. All kinds of normal things take energy to do, many people will die but the population of the earth will increase this year and imo for many years forward so greater demand is the base line. Tell me they refined solar panel efficiency and its a greater threat then this pullback is to oil.

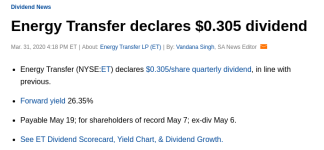

I think its worth some punt, ET $1.22 payout on a $4 share, they own a lot of infrastructure so have revenue at every price I guess. A while back this and WMB were a great bet as once again gas had fallen a lot back then mid merger deal. Not sure its true now but its nicely priced surely

Oil isnt staying low forever as not growing things to eat and so on, has to occur. All kinds of normal things take energy to do, many people will die but the population of the earth will increase this year and imo for many years forward so greater demand is the base line. Tell me they refined solar panel efficiency and its a greater threat then this pullback is to oil.

I think its worth some punt, ET $1.22 payout on a $4 share, they own a lot of infrastructure so have revenue at every price I guess. A while back this and WMB were a great bet as once again gas had fallen a lot back then mid merger deal. Not sure its true now but its nicely priced surely

https://seekingalpha.com/news/35569...tm_campaign=rta-stock-news&utm_content=link-3